Established in 1968 to “provide uniform, consistent, and equitable statewide retirement programs” for firefighters and law enforcement officers throughout Arizona, including those employed by municipalities and other local government entities, as well as Arizona State Highway Patrol employees. The Public Safety Personnel Retirement System (PSPRS) was created to bring equity and uniformity to the then-widely varying pension and retirement programs available across the state.

Recognizing the need for consistency and dependability in pension funding for those “who are regularly assigned hazardous duty in the employ of the state of Arizona or a political subdivision,” the 1968 legislation that created PSPRS mandated that this central system assume possession of the assets and liabilities previously accumulated by local, municipal, and state retirement systems and place them in a special fund. At the same time, prior service credit was transferred to the new, centralized system.

How the System Works

Local boards administer the system on behalf of their public safety personnel. They were tasked with creating and enforcing rules and regulations for the system, as well as providing a forum for grievances and hearings. The local boards do not, however, make decisions on how the system’s funds are invested. They do, however, exercise oversight of the activities of the fund manager, which is appointed by the governor and approved by the state senate. The current PSPRS investment team may be viewed on the PSPRS website.

PSPRS Breakdown and Returns

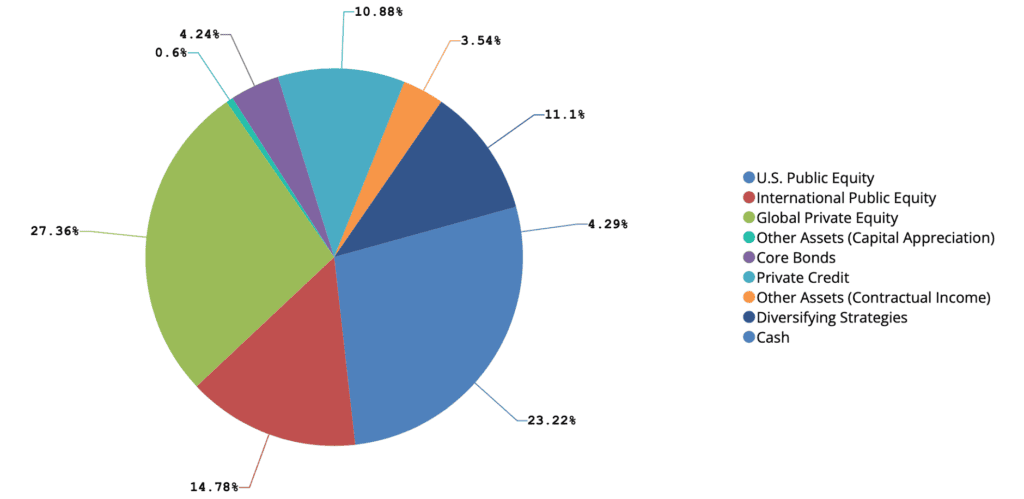

As of the most recent annual report (December 31, 2021), the fund managed assets totaling $14,673,444,114. Assets were divided into allocation classes including US public equity (publicly traded stocks), international public equity, global private equity, other assets (for capital appreciation), core bonds, private credit, other assets (contractual income), diversifying strategies, and cash. As of the date of the report, allocations were divided according to the chart below:

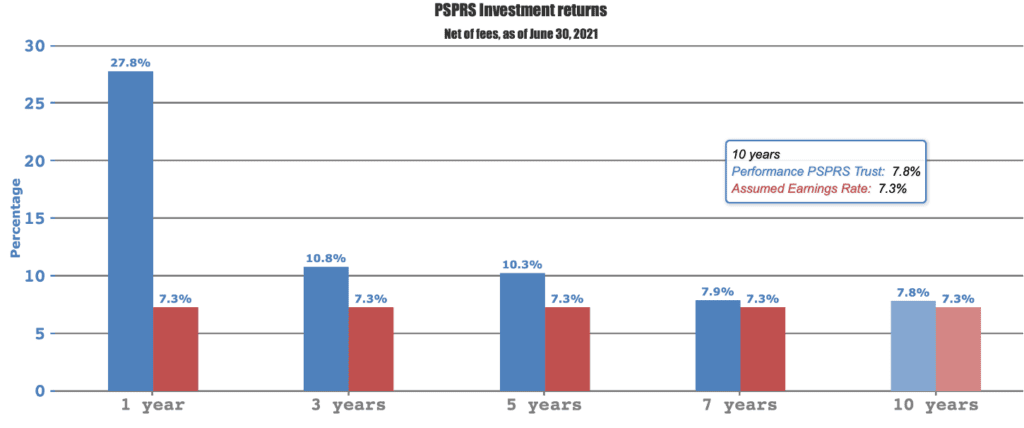

The investment policies of PSPRS fund managers have produced favorable results over the most recent reporting period and also for the longer term. Indeed, one advantage of centralized management of pension funds for all public safety personnel in the state is the ability to achieve both economies of scale with regard to portfolio construction, and consistency of management style for the benefit of all participants. The current assumed rate of return, which determines the pension fund’s estimate of its ability to fund current and future obligations, is 7.3%, and the fund has out-performed this benchmark in both the short- and long terms, as indicated by the following chart.

Recently, legislation was passed that allows the PSPRS to extend the period for deferred retirement option plans (DROPs) from five to seven years, subject to eligibility requirements. (For more information on DROP plans, read our recent article, “Navigating DROP: Making the Right Decision for Your Retirement”). This latest enhancement will offer many public safety officers the opportunity to extend their active employment while adding additional resources for funding their retirements.

PSPRS Final Takeaways

Arizona public safety personnel are fortunate to be able to participate in PSPRS, which affords them the benefit of access to one of the best-performing pension funds in the nation, according to the most recent annual report from Pensions & Investments. For more information, including the latest news and reports, visit PSPRS.com.

Mathis Public Safety Retirement is proud to work with our public safety professionals to make the most of their pension and other retirement benefits. Learn more about our individualized approach to building strategies for financial success.